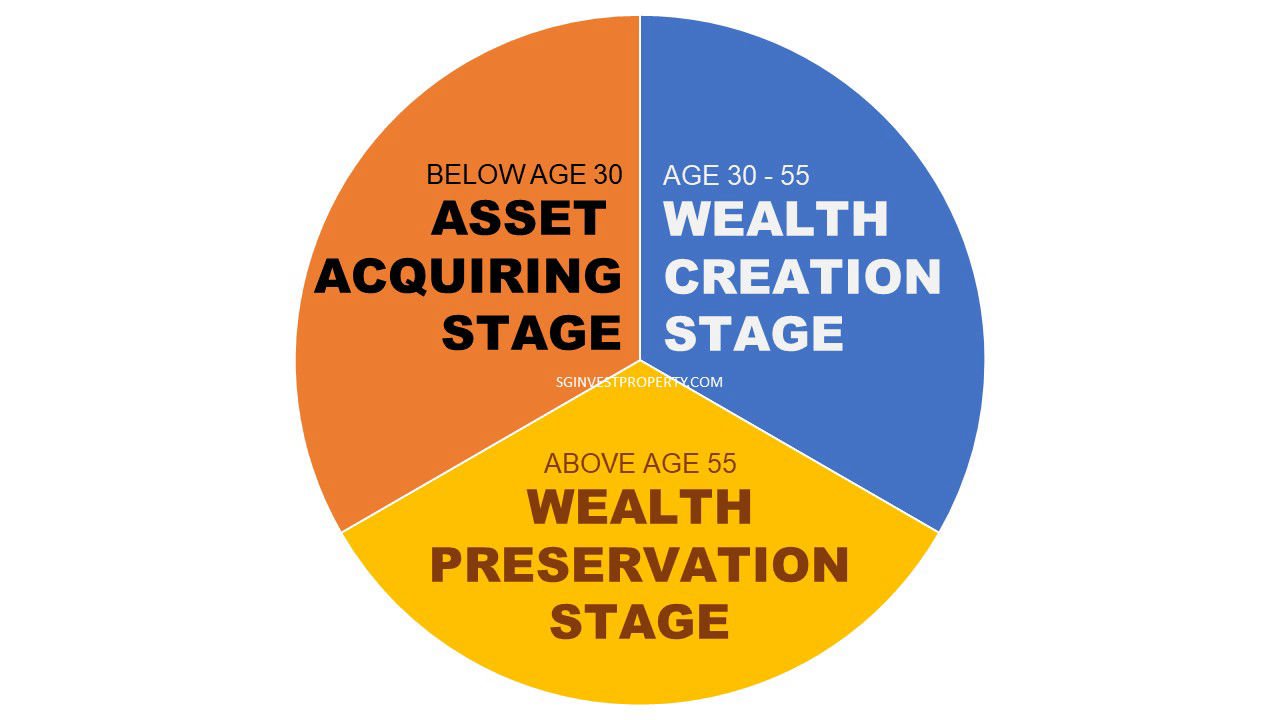

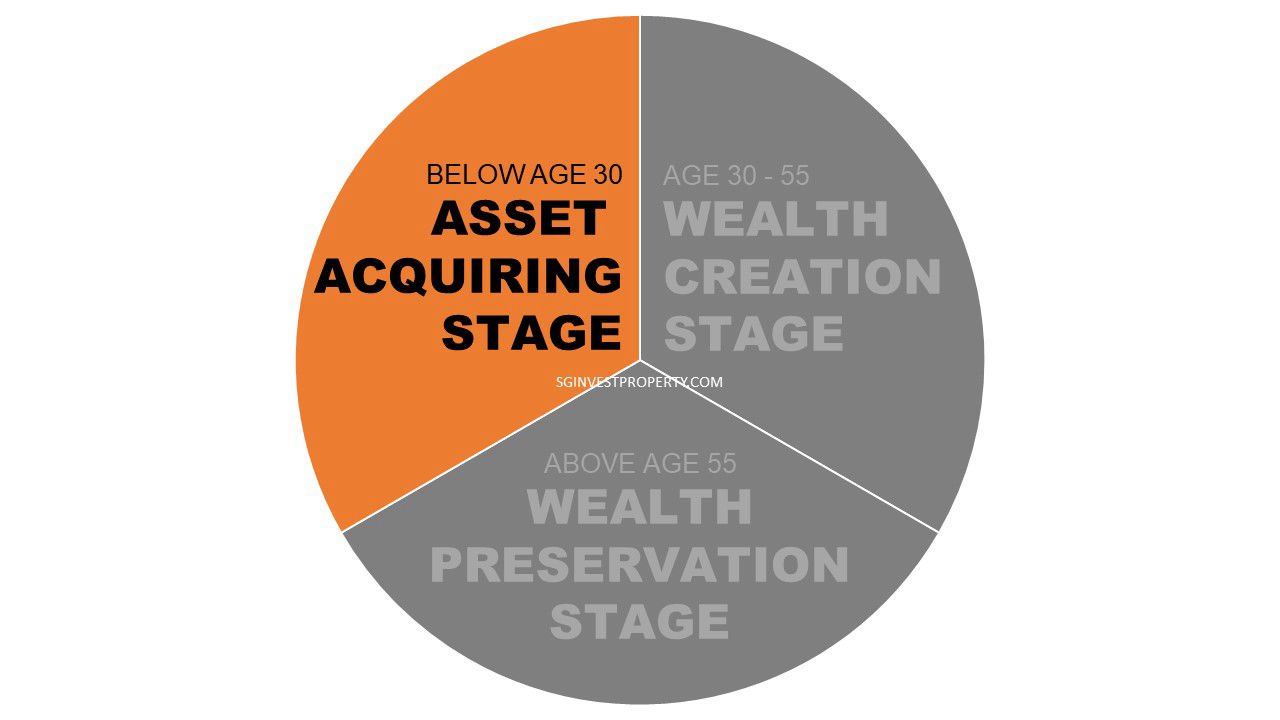

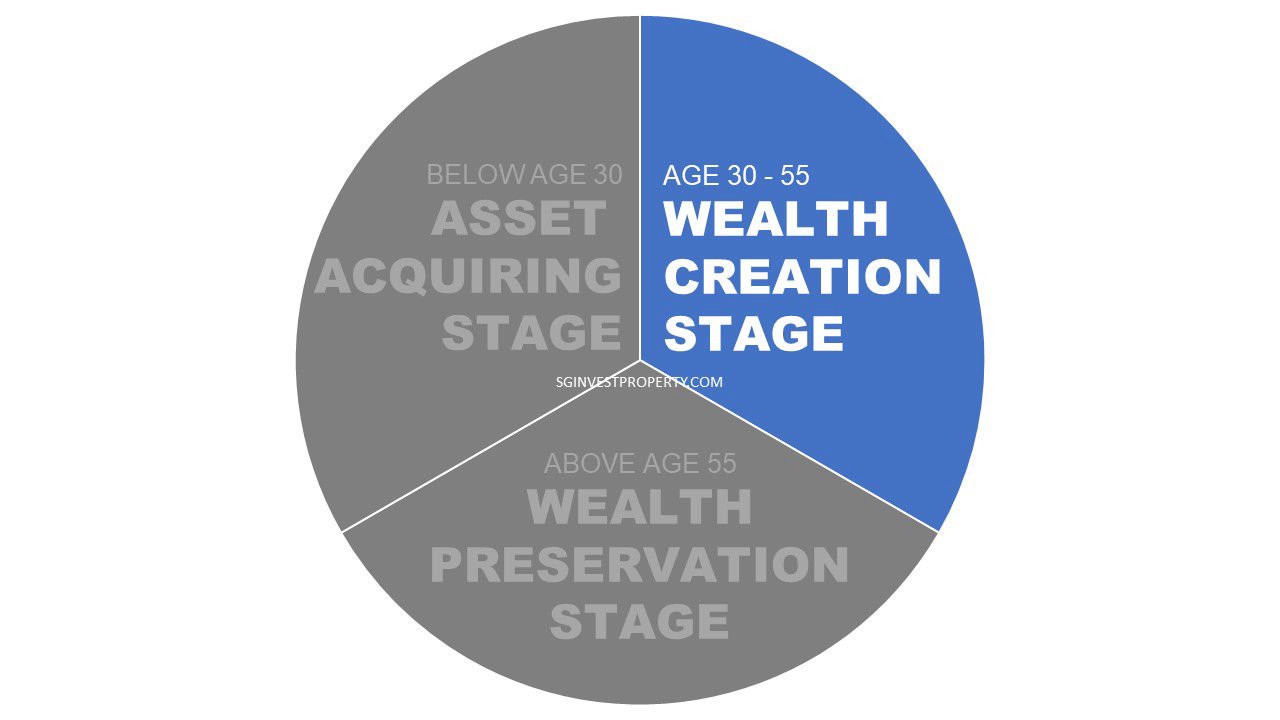

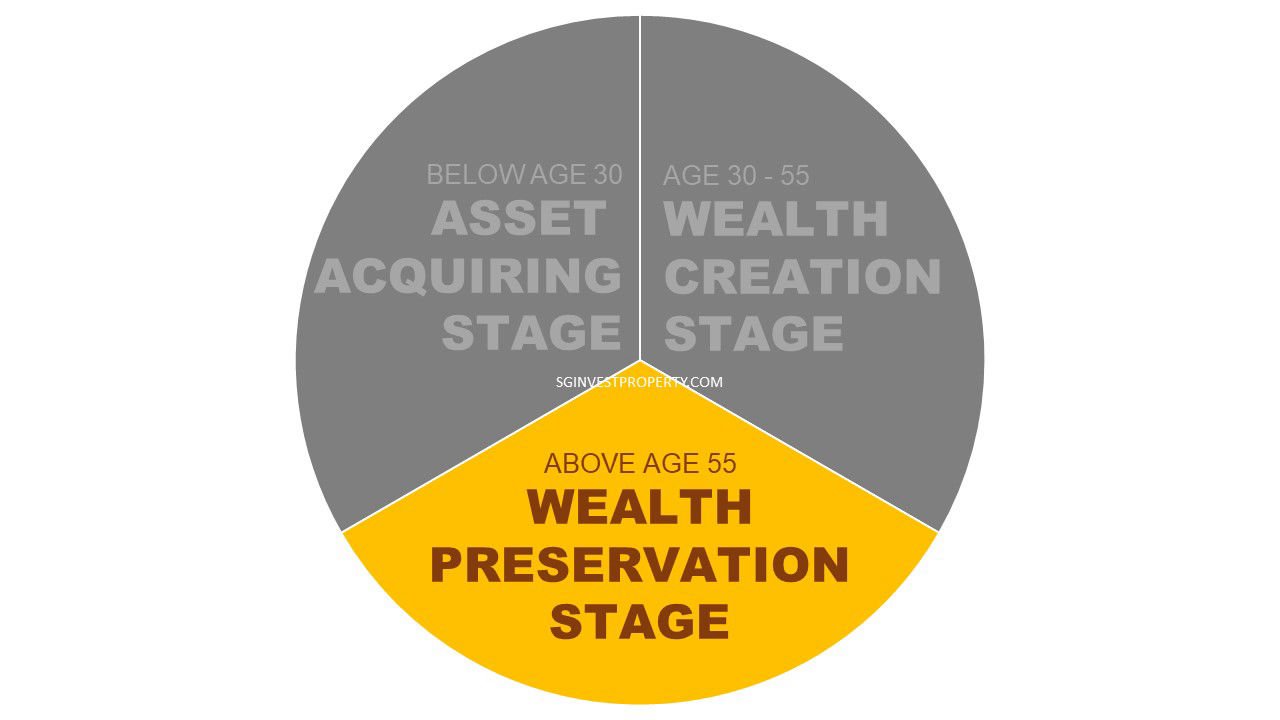

Asset Acquiring Stage (Below Age 30)

We encourage younger people to own the right property as early as possible. Your age is your advantage. You have lesser financial commitments and also able to leverage on the bank to maximise the loan tenure for a lower monthly installment.

You can look at this as a forced savings to create your wealth. Alternatively, you can look at this as an investment. A downpayment of 25% investment and let the rent pays for the installment while waiting for your investment to appreciate.

Property investing usually gives you higher appreciation, lower risk, especially in Singapore where land is scare.

Thus, we advise our client to adopt the right strategy and the right choice of property. This will help you to have an effective early start to wealth creation.

Parents can also adopt this strategy to help your children to have a early start. You can buy the property under Trust for your children below 21.